2019 is the year people following MENA startups can officially say the region has arrived as a startup destination. MENA minted and exited its first unicorn in Careem with its acquisition by Uber which kickstarted 2019 into gear and fueled all time highs in numbers of exits, investments, investors and total dollars invested ($704M up 13% from 2018 ex-mega rounds from Souq & Careem).

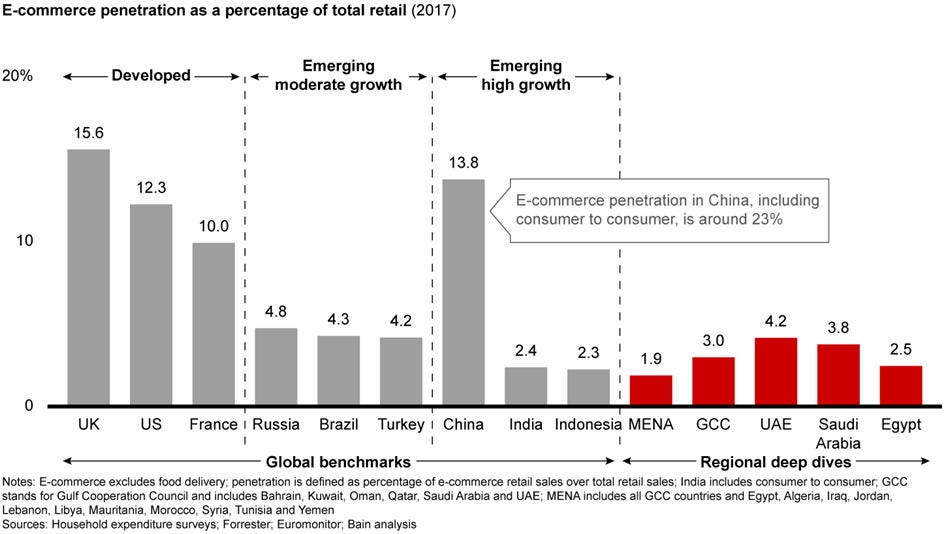

Despite the region’s persistent macro turbulence and disruptions to accessing social media, steady growth in market size & penetration of e-commerce, marketplaces, logistics and fintech are comparable to other high growth markets like India & Indonesia.

Source: Bain & Company

While 2019 marked a banner year for MENA, in 2020 we expect that a maturing ecosystem with two 9-figure exits in 2018 and one billion dollar outcome in 2019 will spark significant startup formation as founders, early employees and angels transition to fund & found many pre-seed & seed ventures. Souq, Careem & Dubizzle successfully scaled to be regional powerhouses and proved that venture scale opportunities can be achieved in MENA at the pace expected since Yahoo acquired Maktoob in 2009.

However, despite these mega-exits, the startup journeys to become regional players have not created a standard playbook for others founders to follow, beyond starting out in the UAE. From our discussions with founders in the region, 2020 is poised for growth rounds funded by both regional VCs, SWF and US based top tier firms.

Venture seems to always have a sense of irony, MENA’s Sovereign Wealth Funds have enabled Softbank’s Vision Fund to fundamentally alter the late stage private market around the world and the world has returned the favor through recent M&A exit activity in the region. Noticeably absent, from the late stage market in the region has been China’s tech giants, Alibaba & Tencent. Despite the headwinds facing China, including the Coronavirus, we expect to see some significant moves by either one or both players in 2020.

The MENA region is dominated by startups that organize the highly fragmented markets & provide last mile solutions using e-commerce, fintech, logistics and marketplaces, so we are watching tools that support entrepreneurs that leverage those platforms catering to local taste and simplifying regional challenges around language, culture and religion.

Given the regional platform & payment rails created by both Careem & Souq via Payfort, we are also keenly focused on startups leveraging Careem’s super app capabilities and Payfort’s ubiquity for fintech solutions at checkout. MENA startup founders operate in the shadow of regional instability, which in the markets that are stable provide an operational halo keeping large global competitors at bay until markets are proven at scale. We expect this trend to continue and MENA founders to also continue to attract the funds to prove they are more than capable to achieve such scale and even grow outside the region.

In 2020, MENA’s ecosystem will see even more organic growth fueled by the following trends we are watching:

E-commerce segmentation and consolidation — we suspect very niche verticals around luxury, shoes and fashion will emerge as the market expands and deepens

Far East & Middle East linkages formed for late stage investments and acquisitions

Regional Neobanks reach escape velocity

Significant startup formation driven by super angels and regional accelerators & funds backed by SWFs