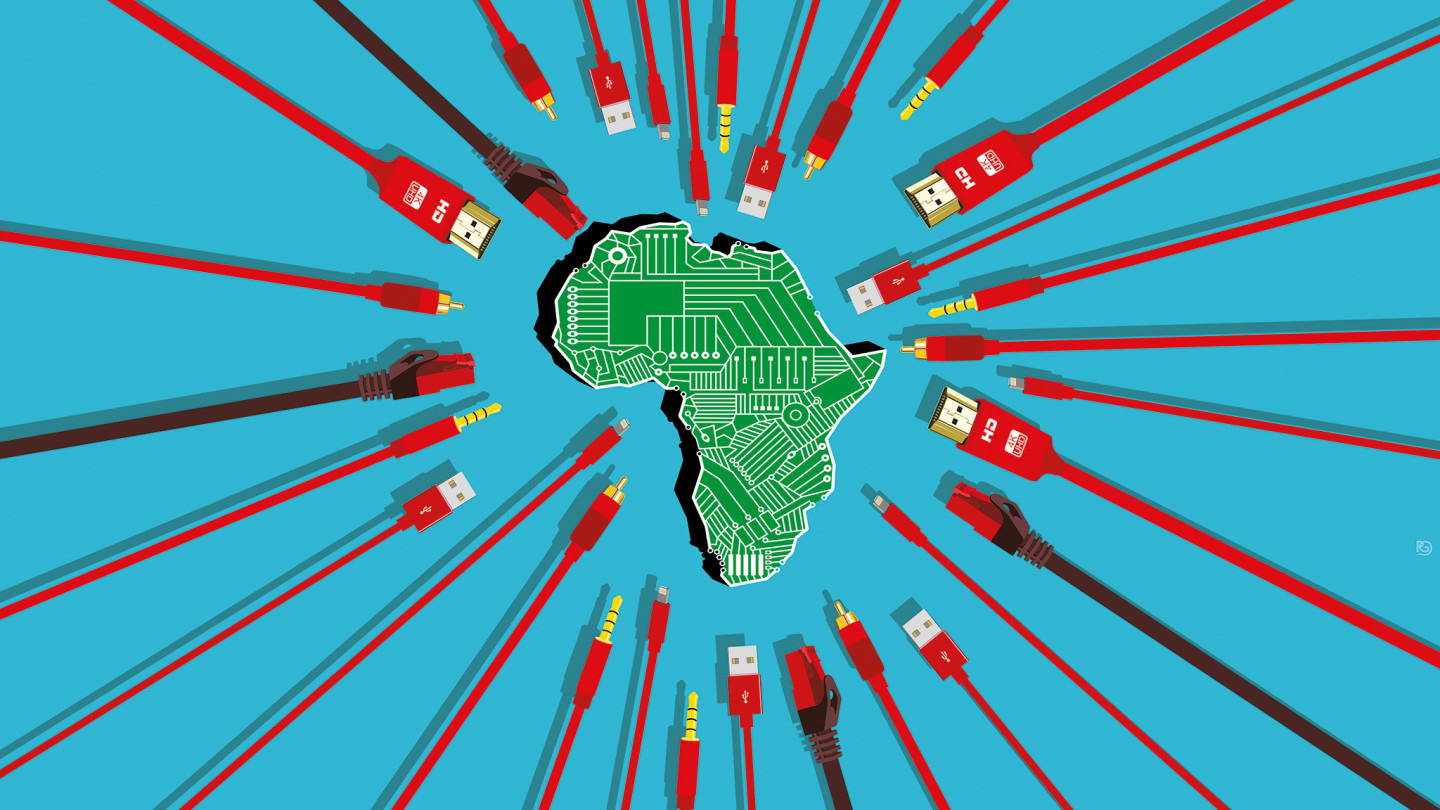

2019 caps an amazing decade in Africa’s tech landscape, from a narrative that centered around evangelizing financial inclusion & smartphones enabling “leapfrogging” traditional infrastructure to 9 figure US dollar funding rounds, anchor African startup slots at Y Combinator & 500 Startups, mushrooming local VC firms, and a freshly minted unicorn in Interswitch. As noted above, 2019 saw over $1B in venture capital for African startups, this represents 10x growth since 2010 and 2020 shows no sign of slowing down.

2020 trends clearly taking shape are best-in-class African companies putting expansion plans into action, leveraging lessons learned to take on the US market, or taking on other global emerging markets or expanding throughout the continent. One thing is for certain, the world has awoken to the African tech opportunity; from tech giants opening regional bases to global CEOs taking up semi-permanent residence. This speaks to the next frontier beyond funding rounds and unicorns, to the African tech landscape birthing members of the $100M ARR club.

We see even more room for African mega-deals, even a few long-awaited IPOs and fintech acquisitions by local banks. 2020 will also be marked by African tech’s ‘Pivot East’: the continued expansion of Chinese tech companies launching in Africa and funding rounds led by Chinese firms. We forecast that Europe and the US VCs & startups will be slow to respond in both pace and volume while African VCs & startups will have to walk a tightrope of competing at home with well-funded Chinese competitors and raising funds from Chinese VCs & tech giants.

Two key sectors we are watching are Fintech-as-a-Service (FaaS) and mobility & logistics. Fintech has risen over the past 5 years to make up over half of the VC funding in Africa. We see that everyone from mobile carriers, legacy banks, employers that extend loans to their employees to even consumer product goods manufacturers harnessing fintech for adjacent market opportunities. Consequently, betting on the founders selling picks and shovels in this fintech gold rush just makes the most sense at this point. The mobility & logistics platforms we see as the most interesting are either organizing freight marketplaces or micro-mobility around motorbikes. We are keenly interested in how mobile wallets and QR code payments converge around mobility startups anchoring Super App consumer behavior, pushing fintech adoption in mass market consumers. African startups have the unique ability to build locally relevant and global applicable solutions and now with increased foreign competitors, I am sure African operators will rise to the task, the bigger question is will forces around regional & continental integration be enablers in the short or medium term?

In 2020, Africa’s tech scene is primed for even more growth and we are watching the following trends:

Origin & valuation of funding for startups Series A and beyond

Regional regulatory sandboxes and passports for fintech operators increasing TAM & market competitors

Naspers appetite for another African mega-deal, like Frontier Cars Group

Increased consolidation and re-bundling of fintech services